How Much Does It Cost To Register An Llc In Michigan

Make sure to reference the table below for the most accurate information.

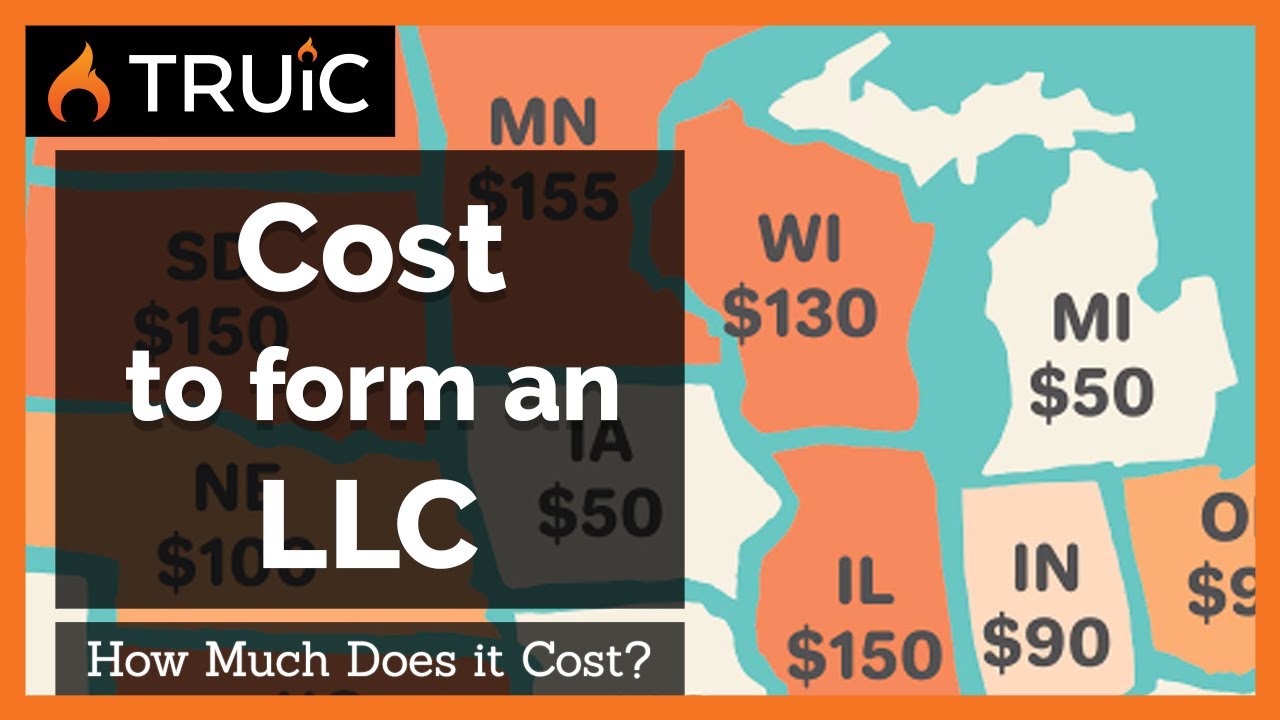

How much does it cost to register an llc in michigan. Make sure to reference the table below for the most accurate information. To start an llc in michigan you must file articles of organization with the michigan corporations division. The articles of organization cost 50 to file. You can apply online in person or by mail. Some fees mentioned in the video above have changed.

As of late 2020 the average llc annual fee in the us is 91. The table below shows llc annual fees by state. 10 for the renewal certificate 25 per annual report filing fee up to 50 per year annual penalty for late filing. A 20 reporting fee is required to file statement of information 90 days after formation and then every two years. The table below shows llc filing fees listed by state as of 2020.

The articles of organization is the legal document that officially creates your michigan limited liability company. Starting an llc in michigan is easy to start an llc in michigan you will need to file your articles of organization with the state of michigan which costs 50. The michigan limited liability company act sets out particular activities which in and of themselves do not constitute transacting business. You can file the document online or by mail. Llc filing fees range from 40 to 500.

Further an annual 800 llc tax is due by the 15th day of the fourth month after llc formation and every year thereafter. In determining whether it is necessary to obtain a certificate of authority the limited liability company should look at its proposed activities in this state the statute and applicable court decisions. If the llc s income exceeds 250 000 it will owe an additional llc tax based on the income amount.