How To Form An Llc Holding Company

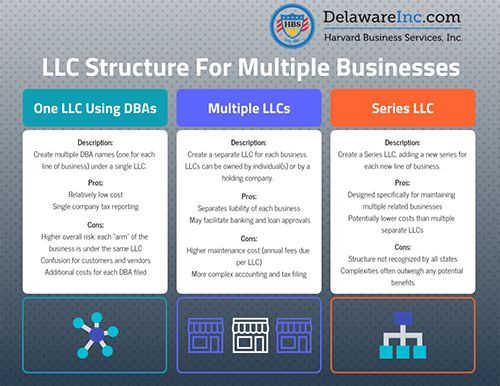

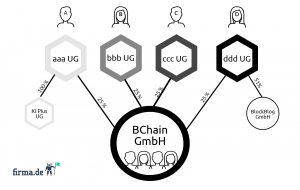

A series llc essentially allows a business to create a holding company structure without having to create separate llcs for each subsidiary.

How to form an llc holding company. You could also create an llc company for each business though this would require you to maintain separate accounting systems and divide up the expenses between each company. Fund the holding company and transfer any existing assets from the operating company to the holding company. If you need help with forming an llc holding company you can post your legal need on upcounsel s marketplace. As you set up your holding company you will need to find a board of directors to manage the holding company and oversee the subsidiaries. The series llc was introduced in 1996 in the state of delaware.

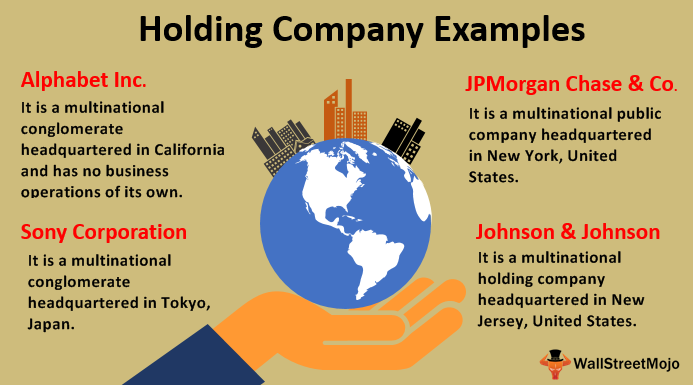

To set up this business structure you must form two separate llcs within your state. For more specific information on how a holding company is taxed be sure to consult a professional with any questions. You can start your own investment holding company by forming a strategy and filing the proper paperwork. Generally speaking the structure of a holding company will look something like this. All holding company and operating company assets must be kept separate to ensure your limited liability protection remains intact.

The holding company or llc is at the top and individual subsidiaries exist underneath it. If you have a business with a significant amount of assets then a holding company would have a true purpose and would be worth forming one to protect the assets. Create and file articles of organization for each llc with the appropriate state agency. Upcounsel accepts only the top 5 percent of. Starting a holding company as an llc or a corporation is a fairly painless task but you should get the help of an attorney to make sure you do it correctly.

You have to make each a separate entity but you can be the agent for both. Choose separate names for the holding and operating llcs. Determine exactly which types of investments you wish to hold. Form an initial investment strategy. Select a registered agent for each llc.

You should form an llc to limit your liability. Forming an llc is relatively simple. While you can file your llc in your state of residence you also have the option of filing a delaware llc or nevada llc. How to form your companies. Open a new bank account for the holding company.