How To Register A Bank Account With The Irs

To be safe you should change the bank account number when you re submitting the tax return.

How to register a bank account with the irs. Follow the steps to register for an online services account. The process is easy and can be completed online. Otherwise the payment will be sent by mail and could be delayed for several months. For example this might happen if you give details for a closed bank account or leave off a digit in one or both of the numbers. The deadline to change a bank account number depends on when you receive your tax assessment.

In usa one could say that a. Otherwise your payment will be mailed to you as a paper check that will slow. In the step for mobile phone verification select receive an activation code by postal mail. An ein can not be used to open a personal banking account only business. The principal responsible official and each employee assigned to use e services products must register individually to create and have access to a secure mailbox.

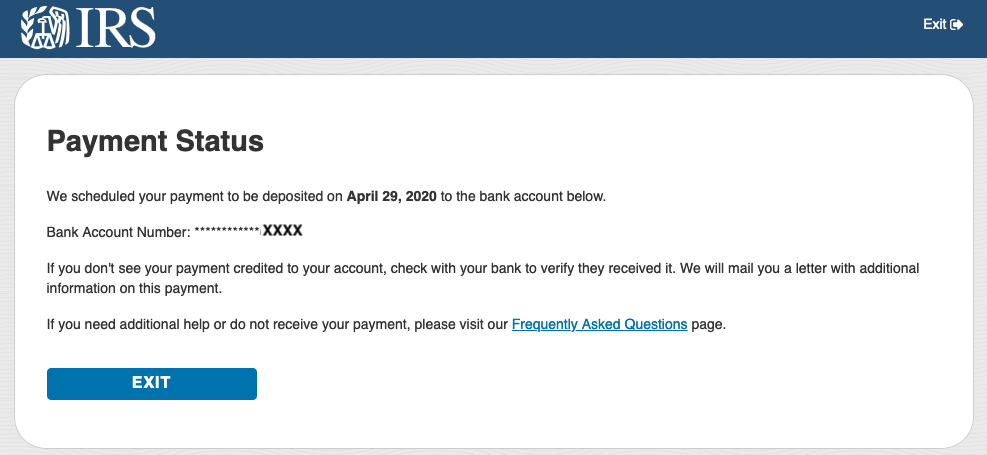

Entering bank or financial account information will allow the irs to deposit your payment directly into your account. In order to establish a business bank account your company must have an ein employer identification number to identify your business with the irs internal revenue service. The key is for the irs to have the direct deposit account information for your bank account. Allow 10 business days for the code to arrive by mail. The code is valid for 30 days.

It can be started before during or after the ives application is submitted but. In that case the irs requires that you contact the bank to handle the issue. To apply for an ein complete an ss 4 application through the internal revenue service. However if you gave wrong numbers that do exist for a real account the irs may have no problem depositing it even if it s not yours. If you are curious about how does the irs find your bank account to recover back taxes through a bank levy this article will be insightful.

Read to know how irs sleuths get hold of the checking bank accounts of tax payers. You can request an ein from the irs and receive an ein verification letter in pdf format in minutes. Request an ein from the internal revenue service. Follow the instructions included with the code to complete registration. If you re too late your tax refund will be deposited into the bank account stated in your tax return.