How To Register A Car Given As A Gift

She will be a high school senior in september and the car is only to get her through this year before setting off for college in september 2020.

How to register a car given as a gift. With the new car owner comes the responsibility of routine maintenance gas and other requirements to maintain the car. Here are the steps you should take before deciding if you want to give someone such a big gift. For example if the car sales tax in your state is 10 and you gift a 20 000 car you can save 2 000 on sales tax. You ll be required to show proper identification and proof of residency. Figure out if you can afford it and what your future obligation might be.

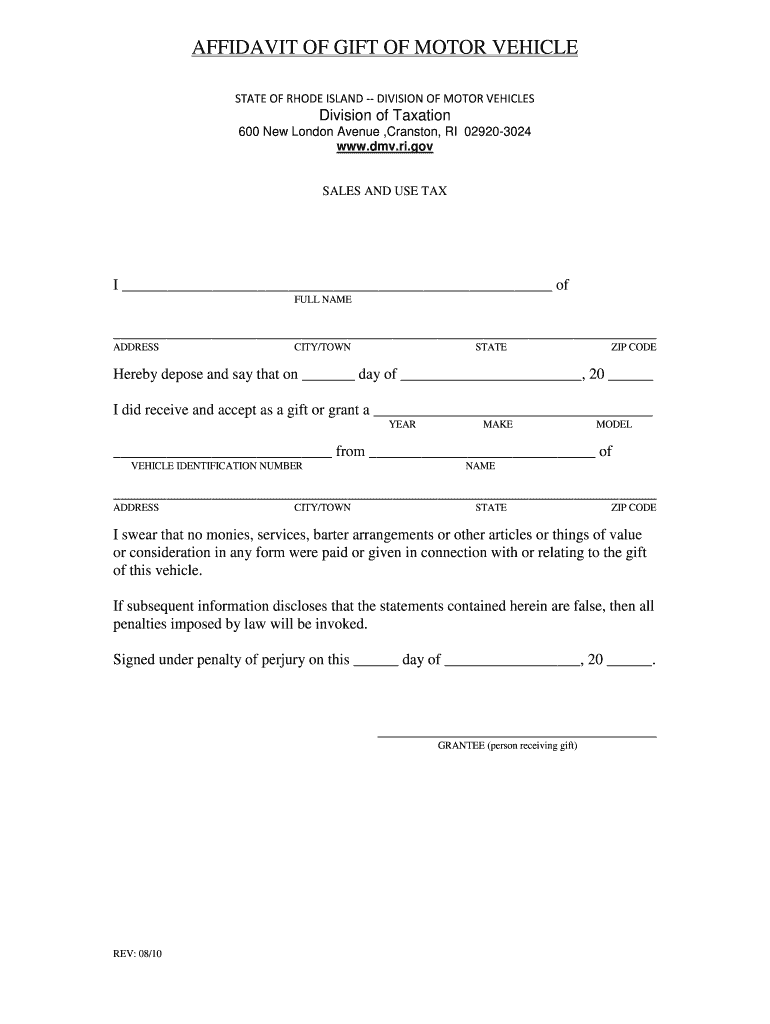

Title bill of sale. Proof of residency proof of identification. But for you as the individual giving the vehicle as a gift check out the following steps to ensure a smooth transaction. A recipient owes income tax only if a car is given in exchange for services. Take the car title or the bill of sale to your local county clerk of courts title office.

To do so both of you will need to go to the title and tag office tell them you re giving the car to the person with you then fill out the gift exemption form mv 13st and declare it is free of conditions and is a gift. Documents that are needed to complete a title transfer when giving or receiving a car as a gift include. They can range from about 30 to 60 each depending on size and quality. The person giving the vehicle has to fill out the required fields on the title which include odometer information and driver s license information. But the recipient of a car given solely out of generosity by the gift giver incurs no taxable income.

Giving the gift of a car to a child a spouse or a loved one can be one of the greatest gifts ever. I am giving my granddaughter my 20 year old car. You ll also need to pay the fees with cash or by check. Before you decide to give anyone this kind of gift whether a child significant other or best friend there are a whole lot of financial and emotional decisions to consider. It isn t because those giant gift wraps are overly expensive.

This usually asks for an odometer reading for the gifted vehicle and the driver s license number of the person giving away the car. Of course if you buy a car and then gift it you will have to pay sales tax on. Don t expect a dealership to throw in a free gift bow. The person receiving the car will fill out the buyer s portion. You need to apply for a new car title and registration.