How To Register Business Efiling

You will need the following.

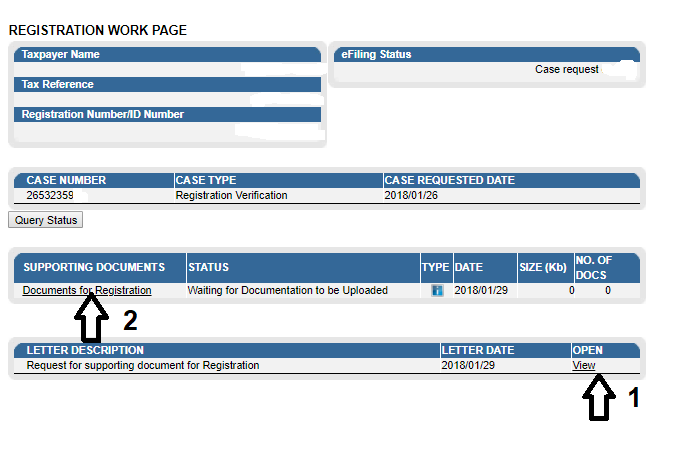

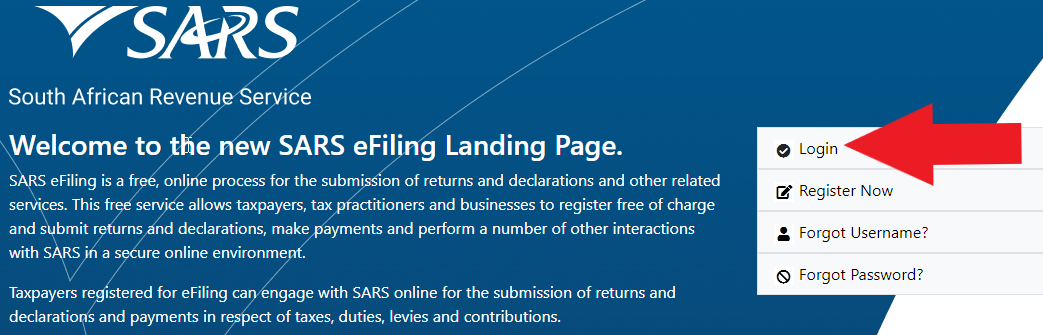

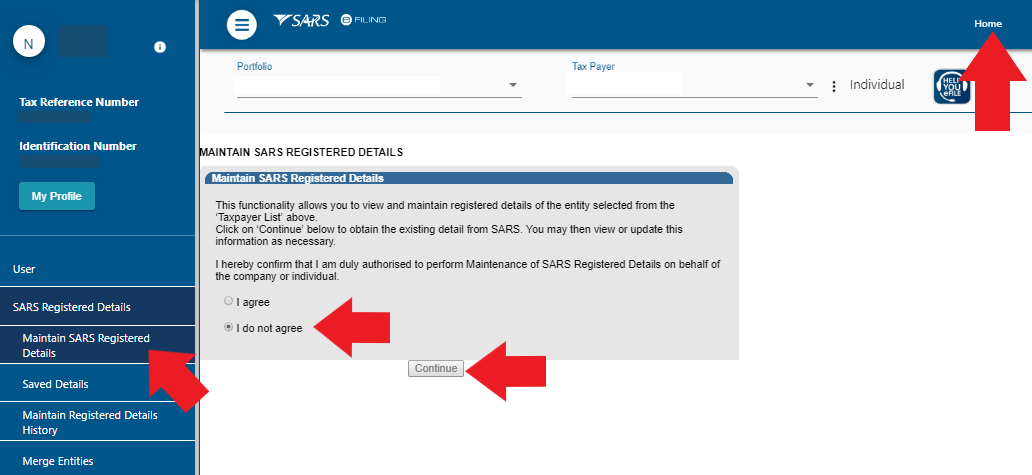

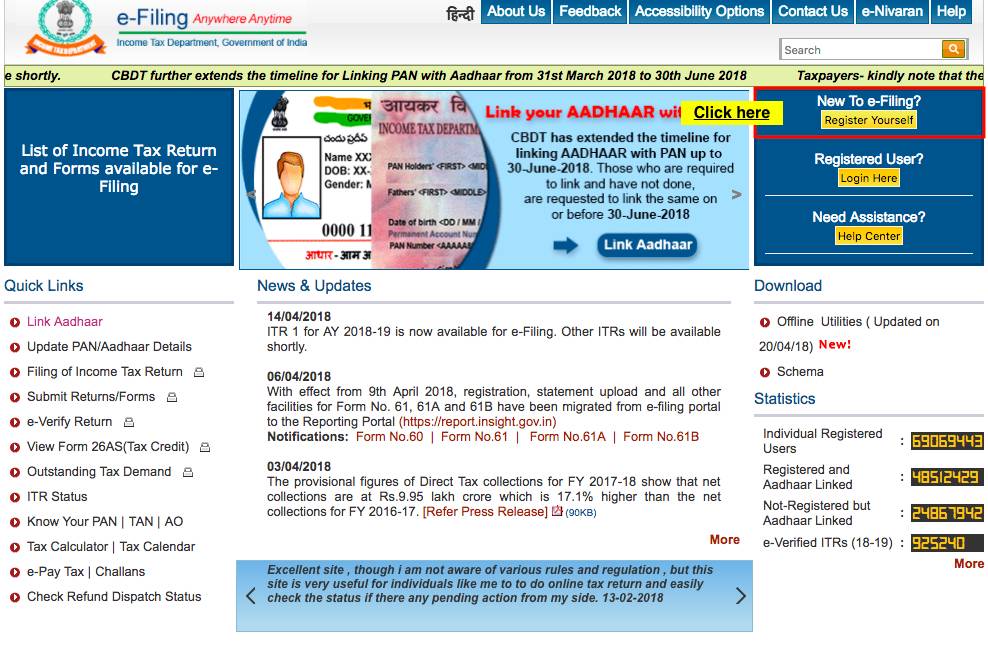

How to register business efiling. But then you should bear in mind that whatever e filing registration process that you are going to embark on it is expected to take place within 60 days that you receive your first income. On the individual portfolio select home to find the sars registered details functionality on the tax practitioner and organisations efiling profiles the sars registered details functionality is under the organisations menu tab 3. The company s banking details 6. To file your income tax return you have to register yourself on the income tax department s e filing website the process of registration is quite easy and simple. Choose the correct user from taxpayer list.

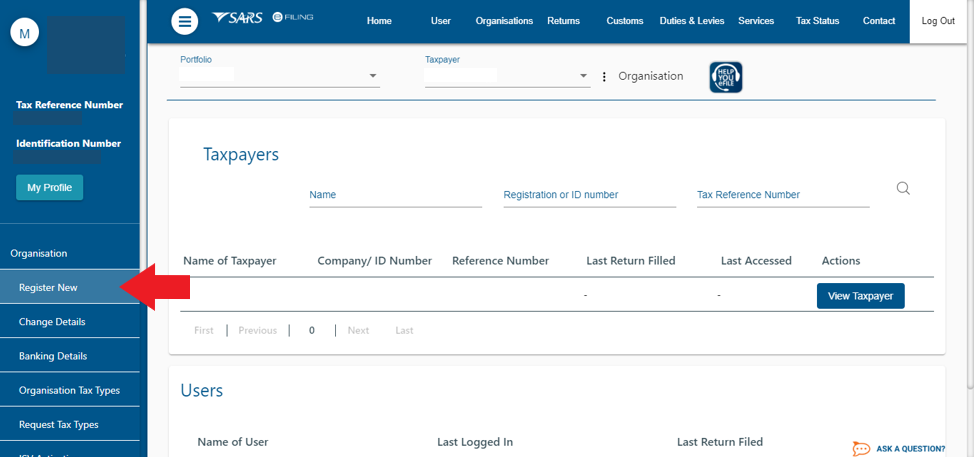

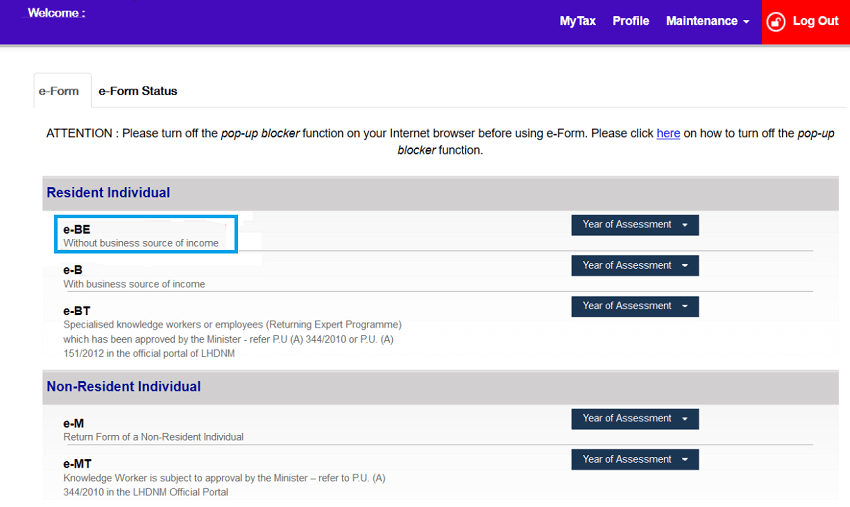

The sars tax number 4. Complete your contact details along with login details that you would like to use then click next. Efilingportal in is also one of the initiative under digital india campaign to register your business online through a portal with complete transparency in all respects. Next to select the assessment year you will be re directed to a new page. To set up a new efiling profile for a company you will need to ensure that you have all your valid documents ready to use during the process.

Select maintain sars registered details. The registration number 5. The year end of the company. More so depending on your needs you have the opportunity to register for efiling as a tax practitioner an individual taxpayer or as an organisation. The address and contact number 3.

27 jan 2016 efiling portal team digital india initiatives digital india is an initiative taken by government of india to integrate the government departments with general public. The efiling register screen will appear where you need to complete your personal details then click next. Click organisation tax types. General disclaimerthese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax acts administered by the c. You must keep your pan card handy to enter the details as required on the registration portal.

Click on the check box for all applicable tax types. Name of the company 2. Select the assessment year from the dropdown menu then choose your assessment year along with itr form number 1 and filing type original or revised return.