How To Register My Llc In Another State

When you move an llc to another state your business is considered a foreign llc in that state.

How to register my llc in another state. The extra fees and paperwork can be avoided by forming the llc in your state of residence. You have to register as a foreign llc with every state where the company makes business transactions file annual reports and pay any fees imposed by the foreign state. Understanding why companies have to register to do business in another state. Depending on the state you may also need to pay state taxes like corporate and franchise taxes. It s perfectly acceptable to have an business that is formed in one state and registered to do business as a foreign llc in one or more other states.

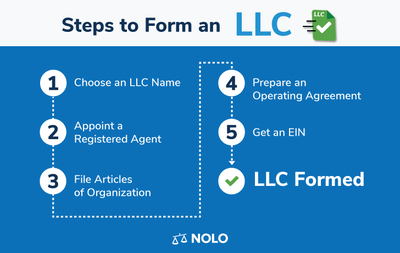

It is considered a foreign company in all other states. It just obtains permission for your llc to do business in the state. Keep old llc and register in new state. The answer to whether or not you need to register your business in another state is very fact specific and is a bit more complicated than it may seem. As a foreign llc you must file for a certificate of authority and pay the required registration fees.

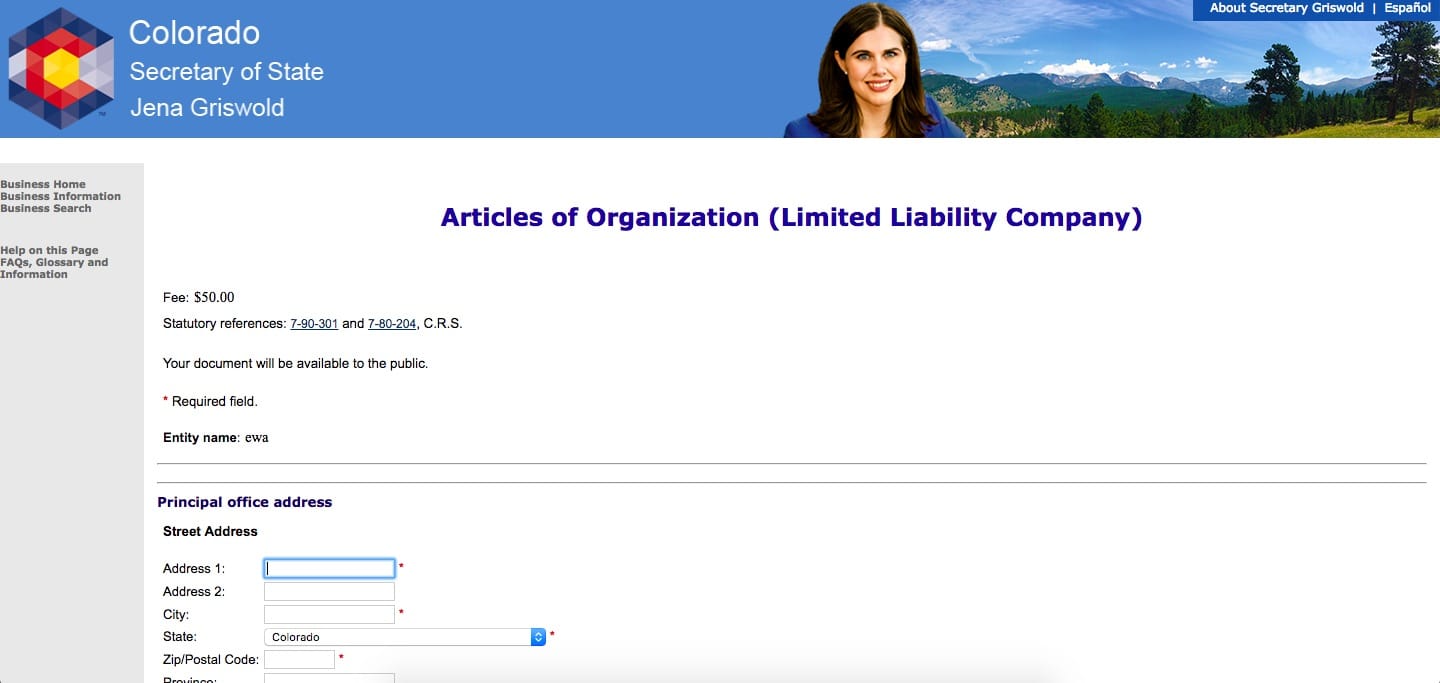

Of course if it is worth it you can incorporate in another state and register as a foreign company in your home state. If you have determined that you need to register your business in another state you will need to submit an application with that state s secretary of state office. The registration does not form a new llc entity. To make matters worse even when the facts are exactly the same the answer can vary from state to state. If you decide to register your llc out of state you should note that you will be considered a foreign llc.

States have the power to prohibit foreign companies from doing. The registration of your llc in a state other than its home state is sometimes called qualifying. Llc limited liability company or other statutory business entity is a domestic company in one state its formation state. You will need to register your llc in each state in which you have a physical presence. A physical presence such as an office or storefront in a state is a strong sign that you need to register your llc in there.

Whenever a company does business within a single state it has to register with the state government which means paying the necessary taxes and filling out paperwork. If you register your llc in one state and have a physical presence in another state you may incur double the fees. You can register your llc in any state that you choose but this is a large caveat of which you need to be aware. This entails filing a form and paying an annual fee which varies from state to state. Perhaps the easiest way to move your llc to a new state is to keep your old llc and register it as a foreign llc in the new state where you want to relocate.