How To Register On Amazon Without Gst

Is it mandatory to register for gst.

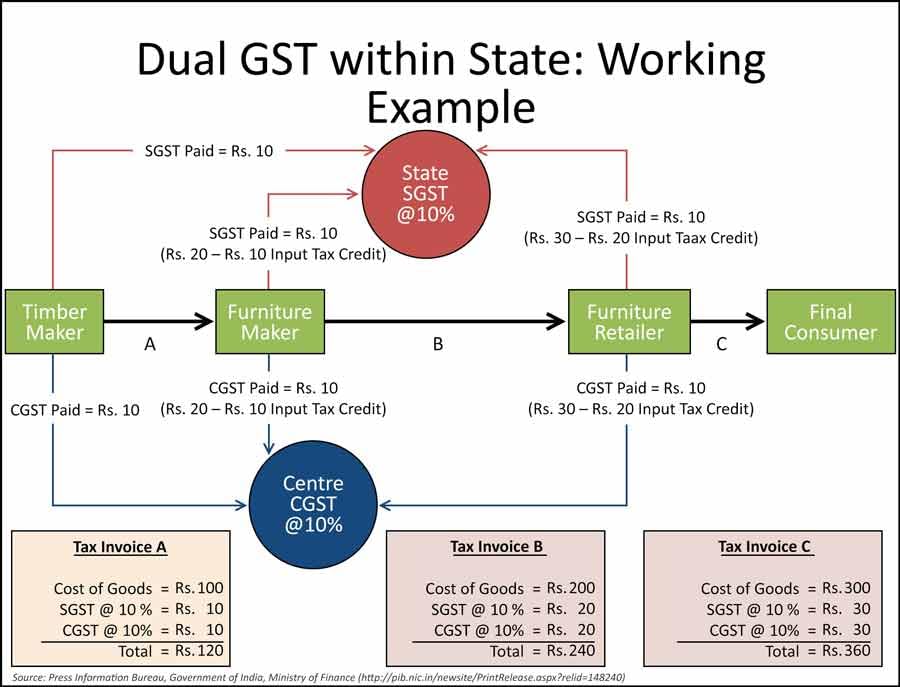

How to register on amazon without gst. As of july 1 2017 any seller who wants to sell across india needs to enrol for gst goods and services tax except if the seller sells goods or services under exempt categories. From the navigation pane choose tax settings. The gst registration process is entirely paperless which means that it will take place online or digitally. Sign on a white paper. Click hereto go to the manage tax detailspage.

It is not mandatory to update your gstin while registering as a business customer with amazon. I am planning to sell online on various platforms but do not wish to register for gst as my turnover is expected to be less than 2 lakhs in a year. In online one has to mandatory register for gst and pay it as per the stipulated rates for a particular category of merchandise. A step wise breakdown of the gst registration process documents required for goods and services tax gst registration. This is an important point if one is going to start an online store or selling point under some platform.

Also see amazon flipkart and other online platforms profit and gst calculator. These platforms also do not allow to register without a gstin. Is it possible to sell online without getting gstin. Every person who wants to sell goods on any of these platforms has to register under gst and get a gstin. Scan or take an image of the signature and upload it on seller central.

To start selling online. Still don t have gst. Select the country from the country drop down menu. Open manage tax registration and then choose add. It is also mandatory to file the gst returns periodically for online transactions and deposit the tax in time.

Do one has to compulsory get gst registration to sell online. In the digital image signature section upload the image signature. However registering for gst entitles business customers to file tax returns and claim input tax credit for the purchases made from business sellers offering business eligible offers for the respective business.