How To Register Small Business With Sars

Small businesses with a turnover of up to r1 million per annum will now be able to pay certain taxes turnover tax vat and employees tax twice instead of once a year making the.

How to register small business with sars. To reduce the administrative burden on small businesses sars introduced a single tax system as a tool for small businesses to help streamline their tax obligations known as turnover tax. General disclaimerthese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax acts administered by the c. 365 001 550 000. 70 700 365 000. The maintain sars registered details screen will display.

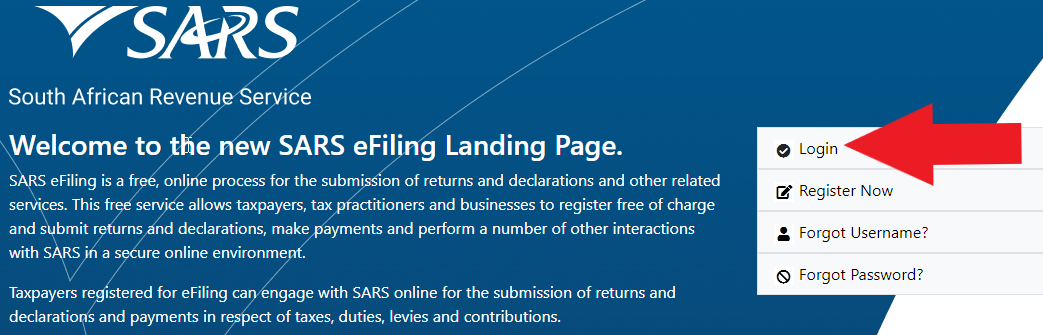

All company registration documents will be available to download the links will be provided in our confirmation email a business bank account can be opened with the cor14 3 registration certificate. Content and data on sars websites and associated facilities including but not limited to software hyperlinks and databases is the property of or licensed to sars and is protected under applicable south african laws. How to register a business in south africa. Select i agree to confirm that you are authorised to perform maintenance functions of the registered details of the company or individual. If you have already registered for efiling in your individual capacity you have to choose the specific user for each business that you would like to do efiling for.

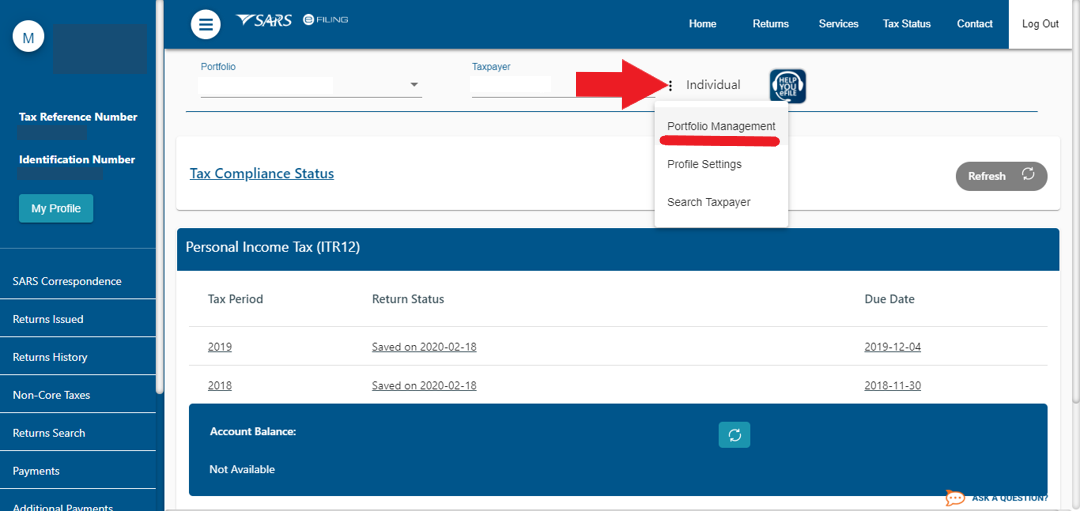

Setting up once you re are on the landing page click on the 3 three dots on top next to the word individual. If not you can register for an efiling profile on the efiling website. Click vat under my tax products revenue on the left menu 6. A tax practitioner if they submit returns on behalf of other individuals or businesses. You can apply for a tax clearance certificate good standing or tender.

If one of your plans is registering a business in south africa especially a small business in the form of a small medium enterprise sme or a startup you will not have to register the entity like a company. In most cases an sme can be either a sole proprietorship or a partnership. Registration must be done within 60 days after starting operations by completing an it77 form available at your local sars office or from the sars website. Choose the correct user from taxpayer list. Select add new product registration to register new or additional vat branch.