How To Open Llc Company In Nj

When should i use this application.

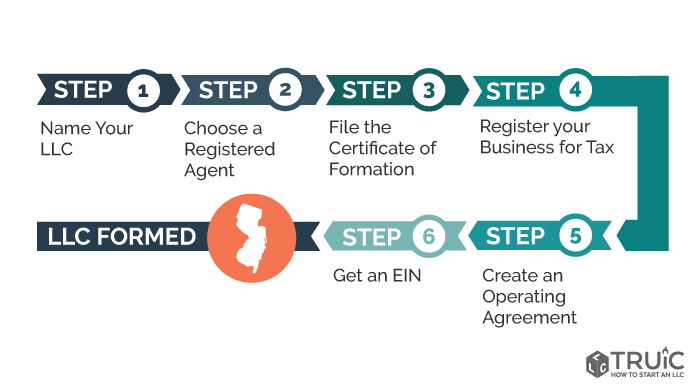

How to open llc company in nj. Form a new jersey llc for 100 plus state fees. Llcs in new jersey are required by law to register for state taxes. This is built off inspiration from the city of san francisco initial design although the code was built from scratch. The state of new jersey recognizes limited liability company operating agreements as governing documents. Starting an llc in new jersey is easy.

For tips on how to use the name search and rules on restricted names. 525 route 73 north suite 104 marlton nj 08053 856 452 1972. Consult our guidance on how to choose a business structure first. Built as open source the business portal is an open source project meant to serve as a resource for anyone who is looking to create an online resource for their own business community. Business name do not enter a designator such as corp ltd llc etc.

The certificate of formation is the legal document that officially creates your new jersey limited liability company. Limited liability company in new jersey business formation services. The llc provides personal liability protection and has the potential to save money on taxes. Learn about the day to day activities of a trucking company owner the typical target market growth potential startup costs legal considerations and more. This is a lot easier than it seems you don t have to spend extra to open you llc i.

Our guide on starting a trucking company covers all the essential information to help you decide if this business is a good match for you. With our step by step guide you can learn how to form an llc in new jersey without an attorney. You may use this streamlined service to file certificates of formation and authorization of business entities. You will add the designator later in the filing process. When you want to start a new business in the state of nj llc pa dp non profit etc when you need to authorize a legal entity in nj for.

Welcome to new jersey s online business formation service. If you choose to structure your business as a limited partnership corporation or limited liability company you will need to form incorporate your business entity with the new jersey treasury department s division of revenue and enterprise services. You will need to obtain one before forming a business in the state of new jersey. To form an llc in new jersey you will need to file the certificate of formation with the state of new jersey which costs 125 you can apply online by mail or in person. Registration may be done online or by mail and must be filed within 60 days of filing public records.